Tensor Capital AI-Powered, Market-Neutral Trading Engine

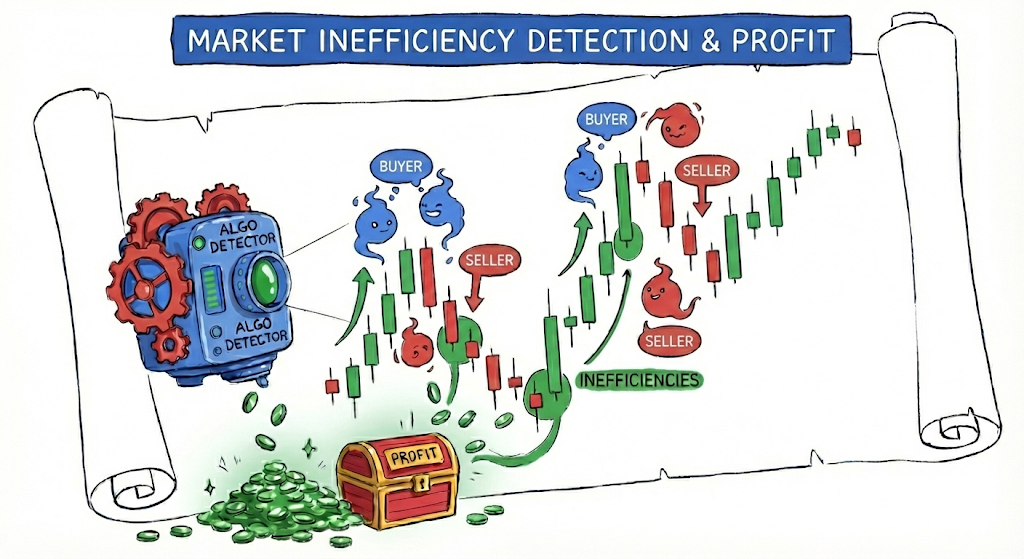

Built by Luwak Technologies Pvt Ltd. Tensor Capital is an intellectual-property driven quant engine using advanced ML, volatility analytics, and low-latency execution to harvest inefficiencies across derivatives and crypto.

| Section | Anchor |

|---|---|

| Overview | #overview |

| Technology | #tech |

| Track Record | #track |

| Industry | #companies |

| Funding | #funding |